Our panel built up the cash reserves in our simulated investment portfolios in late October, ahead of the United States presidential election, and, like pretty much everyone, everywhere, got caught out.

The election of Mr Donald Trump came as a surprise to most, as did the huge market rebound.

In the 13th part of the series introduced by The Sunday Times in January, we look at the lessons learnt during the course of the year and the November performance of the portfolios.

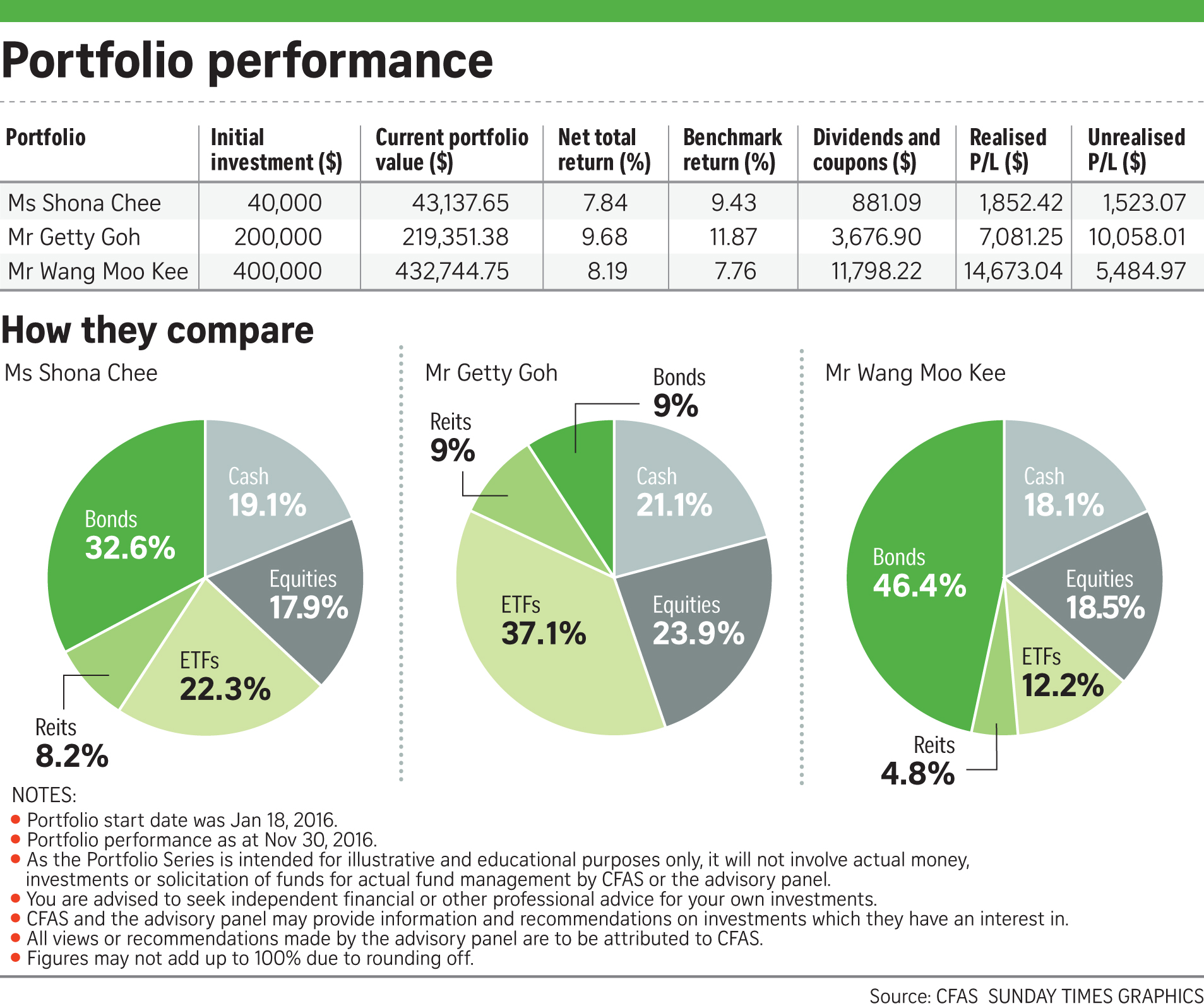

The investors are 26-year-old communications manager Shona Chee, entrepreneur Getty Goh, 38, who is married with two young children, and retiree Wang Moo Kee, 62.

The Portfolio Series does not involve actual money as it is intended only for illustration and education.

Trump supporters at a rally in Baton Rouge, Louisiana, on Friday. The decision to hold cash and to be overweight in gold, which helped deliver outperformance in October, were the main reasons for the relative underperformance last month as equity markets staged a strong rally following the surprising win by Mr Trump.

All three portfolios are limited to instruments listed on the Singapore Exchange to keep them simple, accessible and easy to monitor, and to Singapore Savings Bonds, which can be bought via ATMs.

While there are similarities in the three portfolio holdings, the allocation for each profile differs, depending on the individual's risk-return objectives and preferences.

Each portfolio has a different benchmark that best reflects its mix. Mr Goh's portfolio, for example, is heavier on blue-chip shares, while Mr Wang goes for bonds to reflect his more conservative stance.

The simulated portfolios are constructed by CFA Society Singapore (CFAS) for an ideal investment horizon of five to 10 years. We will track them until the middle of next year.

PORTFOLIO PERFORMANCE

Ms Chee's portfolio was down 0.31 per cent for the month, trailing the benchmark (0.8 per cent) by 1.11 percentage points. Mr Goh's portfolio was up 0.67 per cent, trailing the benchmark (2.13 per cent) by 1.46 percentage points, while Mr Wang's was down 0.39 per cent, trailing the benchmark (-0.24 per cent) by 0.15 percentage point.

The decision to hold cash and to be overweight in gold, which helped deliver outperformance in October, were the main reasons for the relative underperformance last month as equity markets staged a strong rally following the surprising win by Mr Trump.

The security selection within three of the four sub asset classes beat their respective benchmarks. DBS benefited from the recovery in global financials to contribute to the outperformance in the Singapore equities allocation; A-Reit fell significantly less than the S-Reit index while the corporate bond selection outperformed as there was a sell-off in government bonds.

The global exchange-traded fund (ETF) underperformed the benchmark, mainly due to the gold overweight position.

PORTFOLIO ADJUSTMENTS

In the third week of October, the panel had raised cash levels closer to the 20 per cent target.

There were no adjustments made to the portfolios in November.

The CFAS panel said: "We intend to deploy the cash holdings in the upcoming weeks to reduce the cash drag. These changes will be communicated in due course."

CFAS PANEL'S ADVICE TO RETAIL INVESTORS

The panel advises investors to be wary of continued volatility as we near the end of the year. Hedging of forex risk and smart cherry-picking of assets that are attractively valued after the sell-off remain key to decision-making and asset allocation.

"If the Fed adopts a more cautious tone, this would be good news for bond markets. Global equities may remain volatile but there should be buying opportunities for investors seeking good value, starting with high-quality/blue-chip accumulation. In any case, a correction or pullback has been long overdue for several markets with extended valuations," said the CFAS panel.

It added that given the recent sell-off, there are still attractive opportunities for those seeking yield within the emerging-markets space but pick wisely where macro fundamentals are stronger and external positions are solid.

The sixth seminar in the Save & Invest Portfolio Series will be held on Jan 21 from 9.30am to 3pm at the NTUC Auditorium. To register, visit www.sgx.com/academy.

Save & Invest Portfolio Series

The Save & Invest Portfolio Series features the simulated portfolios of a young working adult, a married couple with two young children and a retiree over a 12-month period. It guides retail investors in basic investment techniques and on how to build a portfolio in line with their financial goals and risk tolerance.

This initiative involves the Singapore Exchange (SGX) collaborating with CFA Society Singapore (CFAS) and MoneySense, the national financial education programme.

The CFAS panellists tracking the simulated portfolios are Mr Phoon Chiong Tuck, head of fixed income at Lion Global Investors; Mr Jack Wang, partner at Lexico Capital; Mr Praveen Jagwani, chief executive of UTI International, Singapore; and Mr Simon Ng, CEO of CCB International (Singapore).

Due to requests from readers, you can now access past articles in the series, as well as monthly portfolio reports, by clicking on the Save & Invest Portfolio Series banner at www.sgx.com/academy.

This article was first published on Dec 11, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.